Transactions

Sale-Leaseback – Industrial / Manufacturing Acquisition

Toccoa Capital Management acquired an industrial / manufacturing facility in Dalton, GA through a sale-leaseback transaction with TIW Machine & Fabrication, a ReNew Manufacturing Solutions portfolio company.

$3,300,000 – Joint Venture Equity

Toccoa provided joint-venture equity to Beacon Companies for the development of two single-tenant flex industrial buildings in Murfreesboro, TN.

$630,000 – Senior Secured Bridge Loan

Toccoa provided a senior secured bridge loan collateralized by a commercial property in Columbia Falls, MT. This loan was closed in just six (6) days after the term sheet was signed.

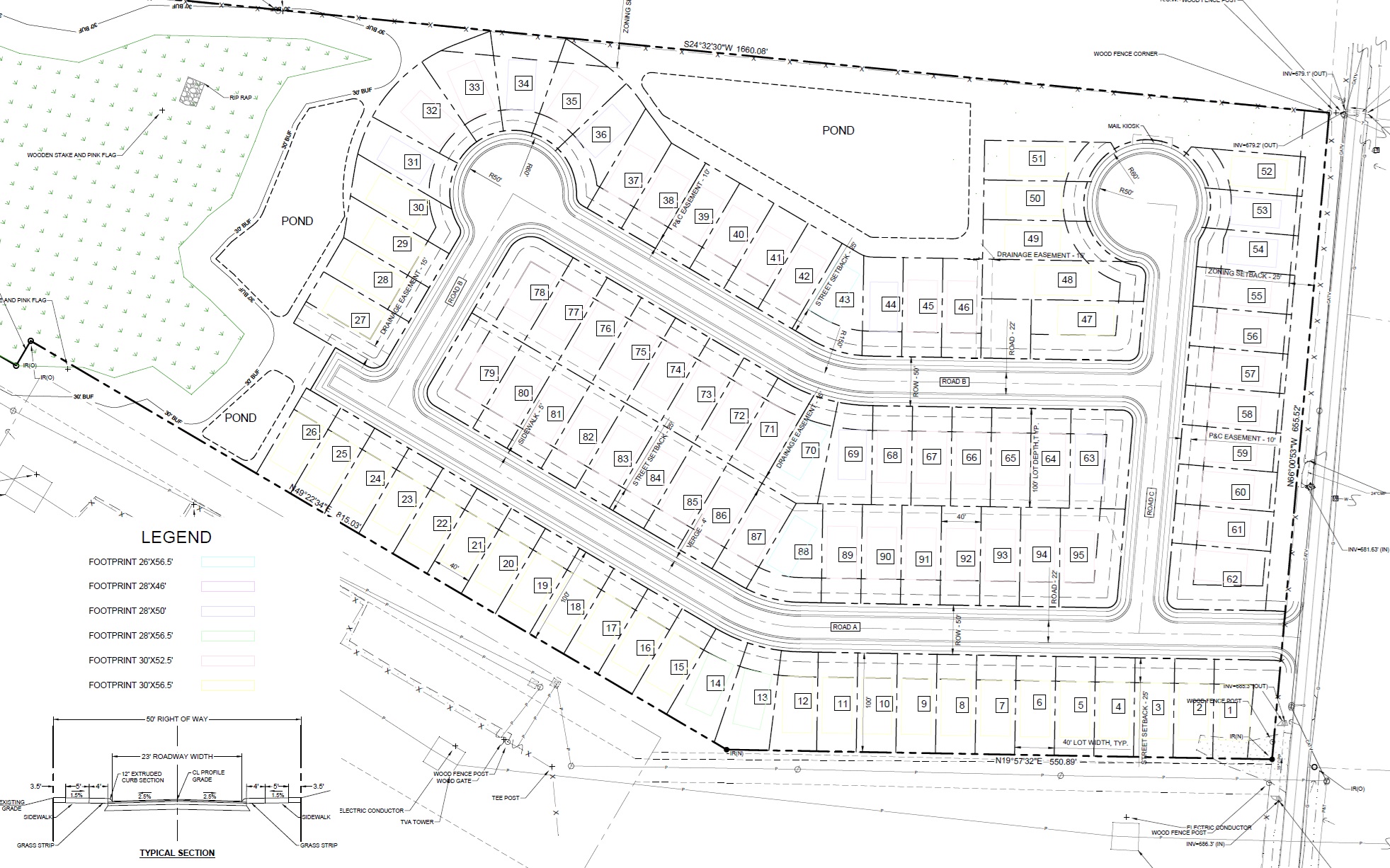

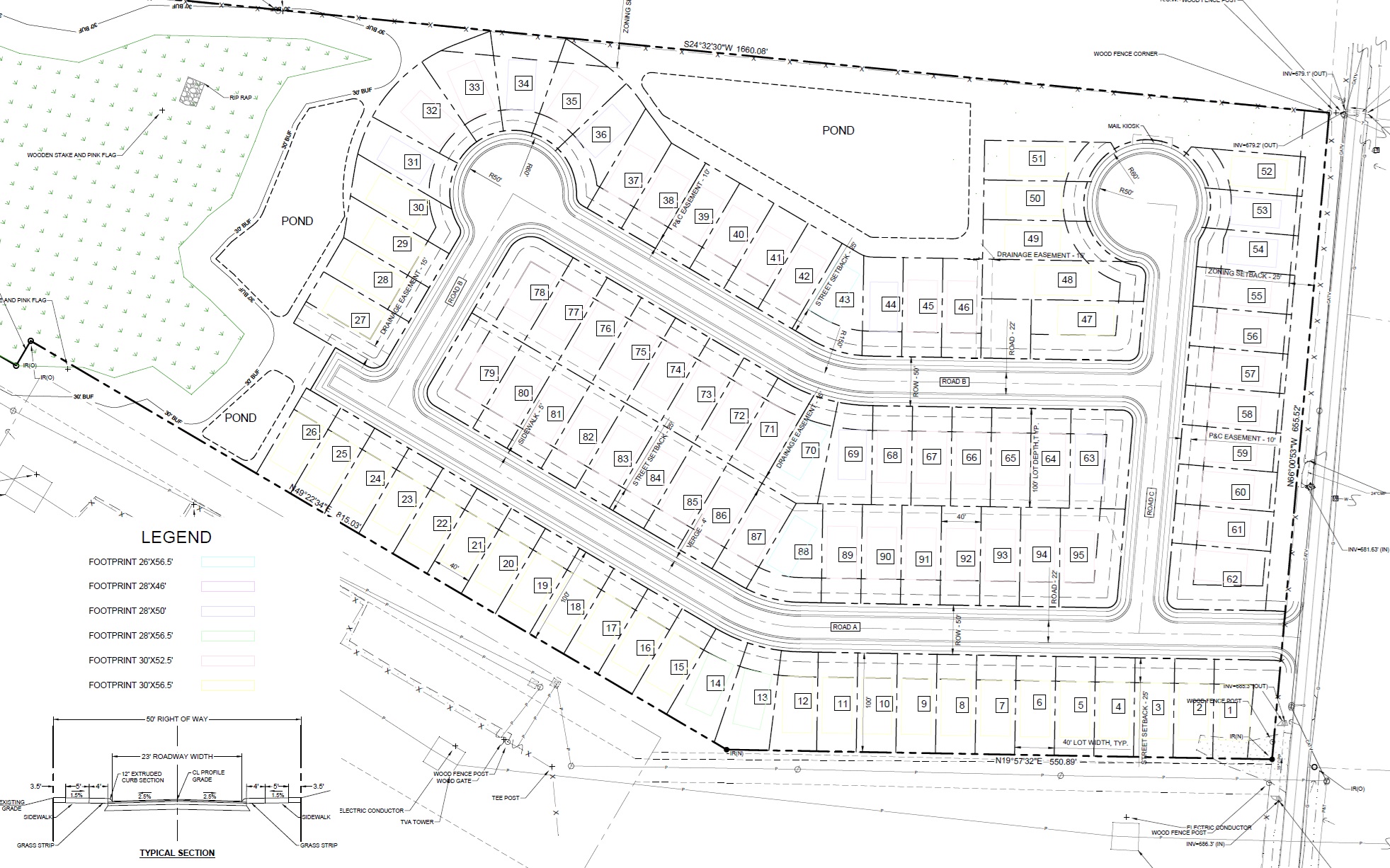

$4,000,000 – Off Balance Sheet Land Bank

Toccoa provided $4,000,000 in capital to facilitate an off-balance sheet land banking transaction for a ninety-five (95) lot residential development known as Davidson Meadows, located in Chattanooga, TN.

Sale-Leaseback – Industrial / Manufacturing Acquisition

Toccoa purchased two industrial/manufacturing properties near State College, PA in a long-term sale-leaseback transaction with Interfuse Manufacturing. This transaction was closed in conjunction with ReNew Manufacturing Solutions acquisition of the company.

$3,625,000 – Senior Secured Term Loan

Toccoa provided a senior secured term loan secured by all assets of a private homebuilder, in addition to mortgages on certain entitled residential subdivisions. Toccoa closed the loan within two (2) weeks of signing the term sheet.

$2,000,000 – Senior Secured Term Loan

Toccoa provided a senior secured term loan secured by all assets of a private mortgage REIT. The assets consist of various 1st and 2nd lien loans on commercial real estate scattered across the USA with a primary concentration in the Pacific Northwest. Toccoa closed the loan seven (7) days after the term sheet was signed.

$6,930,000 – Joint-Venture Equity

Toccoa provided joint-venture equity to Artemis Hotel Group for the acquisition and reposition of the Homewood Suites by Hilton – Galleria/Cumberland in Atlanta, GA.

Build-to-Suit – Take 5 Oil Change

Toccoa secured the exclusive right to develop five (5) locations throughout Tennessee, Kentucky, Minnesota, and Wisconsin for a Take 5 Oil Change franchisee. Toccoa and the franchisee will enter a fifteen (15) year absolute triple-net (NNN) lease agreement for each of the properties.

Sale-Leaseback – Industrial / Manufacturing Acquisition

Toccoa purchased an industrial property in Leander, TX (Austin MSA) in a long-term sale-leaseback with Absolute Machine & Tooling. This transaction was closed in conjunction with ReNew Manufacturing Solutions acquisition of the company.

$2,718,000 – Joint-Venture Equity

Toccoa provided joint venture equity to an established Atlanta based real estate developer for the development of a boutique infill townhouse development in the Toco Hills neighborhood in Atlanta, GA. The property is located near major employment centers such as Emory University, Emory Hospital, Centers of Disease Control and Prevention, and Childrens Healthcare of Atlanta. The project will consist of eighteen (18) townhouses when complete.

$3,750,000 – Loan-on-Loan Financing

Toccoa provided Loan-on-Loan financing to a well-established fix and flip hard money lender. The loan was secured by a collateral assignment of a subset of loan documents held by the hard money lender, with Toccoa’s loan-to-value not exceeding 45% of the collateral value. The assets held by the hard money lender consist of various 1st lien loans secured by residential and multifamily properties scattered across the USA.

$890,000 – Co-GP Equity

Toccoa provided Co-GP equity to facilitate the acquisition of the Staybridge Suites in Tallahassee, FL. This investment was made in partnership through its investment in Artemis Hotel Group, which sponsored the acquisition. The venture entered into a new 15-year franchise agreement with IHG Hotels & Resorts.

$500,000 – Co-GP Equity

Toccoa provided Co-GP equity to facilitate the development of a new one hundred and twenty-four (124) guestroom Extended Stay America in Pensacola, FL. The property is located in close proximity to the Naval Air Station – Pensacola. This investment was made in partnership through its investment in Artemis Hotel Group, which sponsored the development.

$2,300,000 – Joint Venture Equity

Toccoa provided joint venture equity to an established value-add multifamily operator for the purchase of a multifamily property totaling 75 units in Baldwin, GA. The venture will heavily invest in both interior and exterior renovations in order to improve the overall quality and operations of the property

$635,000 – Co-GP Equity

Toccoa provided Co-GP equity to facilitate the acquisition of the Hilton Garden Inn in Stonecrest, GA. This investment was made in partnership through its investment in Artemis Hotel Group which sponsored the acquisition. The venture entered into a new 15 year franchise agreement with Hilton and will heavily invest in both interior and exterior renovations in order to improve the overall quality and operations of the property

Platform Investment

Toccoa has made a platform investment in Artemis Hotel Group to pursue value-add and development opportunities in the hospitality space with an emphasis on the extended stay and limited service verticals.

$3,000,000 – Joint Venture Equity

Toccoa provided joint venture equity to an established value-add multifamily operator for the purchase of a multifamily property totaling 95 units in Austin, TX, just 2 miles south of The Domain. The venture will heavily invest in both interior and exterior renovations in order to improve the overall operations and quality of the property.

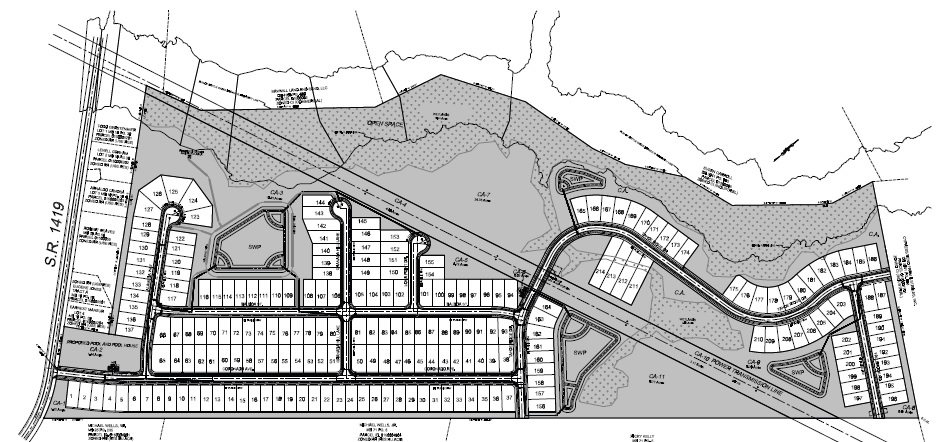

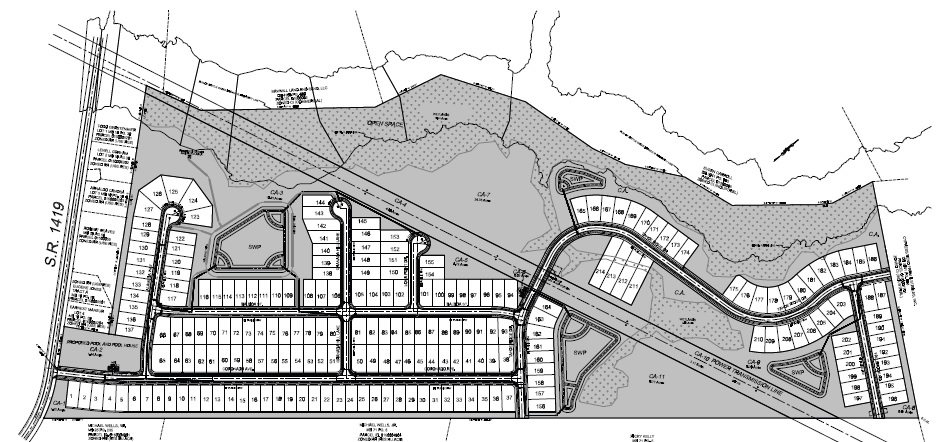

$2,900,000 – Senior Loan

Toccoa closed on a $2.9mm land loan secured by 100 acres in Wilmington, NC, zoned for 214 single family homes. The sponsor, an experienced land developer in the Carolinas, was required to close on the land prior to issuance of all necessary land disturbance and utility permits. As part of the financing provided by Toccoa, it secured a purchase option for the property, which must be exercised once all required permits are in place.

$1,200,000 Joint Venture Equity

Toccoa provided joint venture equity to an established real estate developer to construct three build-to-suit urgent care facilities located in Locust, NC, Cherryville, NC, and Augusta, GA. The tenant entered into a 15-year triple net lease with the developer upon closing of the transaction.

$2,650,000 Flex-Office Portfolio Acquisition

Toccoa acquired a two-building flex-office portfolio in Peachtree Corners, GA and Norcross, GA. The buildings are 13,300 SF and 7,700 SF respectively.

$615,000 Senior Loan – Self-Storage

Toccoa provided a $615,000 senior loan to facilitate the acquisition of a self-storage property in Maryville, TN. The borrower was pursuing an SBA loan to acquire the property, but due to timing issues with the SBA, the borrower needed a quick loan to close the transaction. Toccoa closed the loan one week from the signing of the term sheet with the borrower.

$3,200,000 – Joint Venture Equity

Toccoa provided joint venture equity to a well-known Georgia based multifamily operator for the purchase of two multifamily properties totaling 166 units in Athens, GA.

$2,400,000 – Joint Venture Equity

Toccoa provided joint venture equity to a well-known Georgia based multifamily operator on the purchase of a 100-unit multifamily property in Austell, GA.

$2,900,000 – Joint Venture Equity

Toccoa provided joint venture equity to a well-known Georgia based multifamily operator on the purchase of a 120-unit multifamily property in Austell, GA.

$10,000,000 – Flex-Industrial Acquisition

Toccoa acquired a two-building flex-industrial property totaling over 130,000 square feet in Technology Park / Johns Creek.

$6,200,000 – Bridge Loan – Economy Extended Stay Property Portfolio

Toccoa provided a bridge loan to facilitate the acquisition and repositioning of two Studio 6 Extended Stay Hotels in Ocean Springs, MS and Pascagoula, MS.

$937,590 – Non-Performing Note Acquisition

Toccoa acquired a non-performing loan from a regional bank, secured by an 8,000 SF flex-office property located in West Midtown (Atlanta), GA.

$1,200,000 – Senior Loan – Industrial (Cold Storage)

Toccoa provided a $1,200,000 senior loan in order to refinance the asset and provide the owner with working capital to address other cash flow needs. Toccoa closed the loan in less than two weeks from the signing of the term sheet.

$3,700,000 – Off Balance Sheet Land Bank

Toccoa provided $3,700,000 in equity capital to lead an off-balance sheet land banking transaction in Ft. Collins, CO for a national homebuilder.